In this corporate world, companies are using various software’s to smoothen and fasten the workflow of an organization. Payroll Software is one of them which are usually used to automate the payroll processes. Good payroll software can also result in the increased efficiency and productivity of the employees. Because salary often serves as a motivating factor for any employee.

Any inconvenience caused in the payroll process might result in the loss of an efficient employee. Especially, in large organizations where there is a huge number of employees working together, there must be no confusion while crediting the salaries. So, payroll software is a compulsion for any organization. Below are a few more reasons why should you consider suitable payroll software.

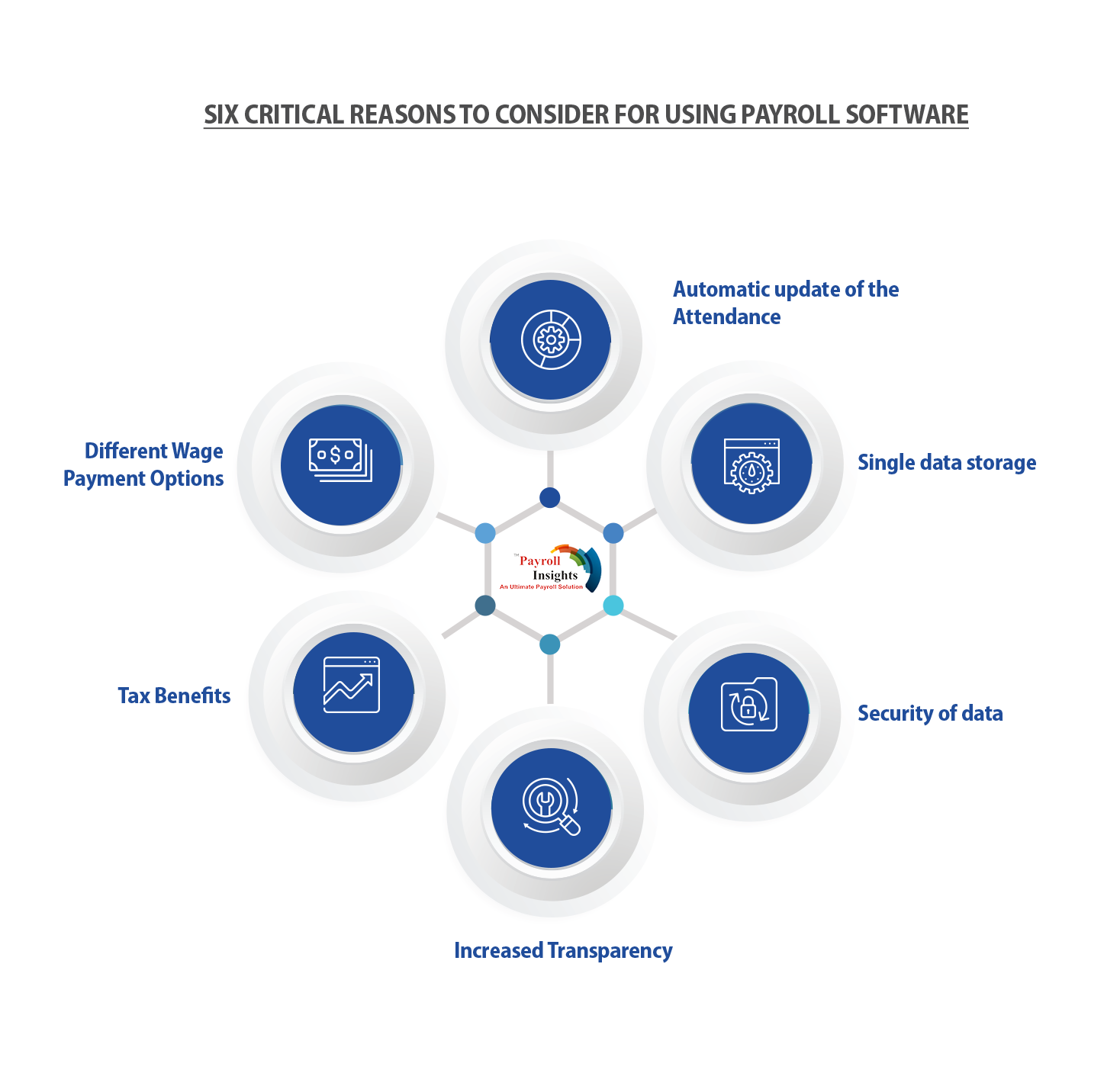

1. Automatic update of the Attendance

With the best payroll software in hands, you can easily calculate the attendance details of your employees in real-time from anywhere. The payroll software’s are also made accessible to mobiles these days so that everyone related to the HR team of an organization can calculate the employee logging in and logging out timings.

2. Single data storage

To need not to use multiple files to store data regarding different aspects like attendance, leave, reimbursement, TDS, etc. Instead, you can synchronize all these processes to single payroll software which indeed saves a lot of memory space as well.

3.Security of data

Data breaches can be great trouble in any business. So, especially in payroll where there is an involvement of money security is a prime concern as employees data is all related to money. Using a good payroll software helps in ensuring safety to the data as it cannot be accessed by anyone who doesn’t belong to your organization.

4. Increased Transparency

Payroll software helps in increasing the level o[f transparency between employers and organization. Since this software’s are mostly based on the cloud the employees can see all the details of their salary and tax whenever they need them.

5.Different Wage Payment Options

The Payroll software lets you pay the wages in various options such as Pay cards, direct deposits, printed checks, and handwritten checks. All that is required is just to download the payroll app to choose the mode of the payment. In many organizations, there are different payment methods for different employees who are in and out of the prohibition. Good payroll software helps in storing the mode of payment and credit accordingly.

6. Tax Benefits

Good payroll software helps in notifying the updates regarding the taxes. With these, organizations can prevent the risk of paying fines on the taxes. There are some software’s which automatically files the taxes of every employee. All they need to do is just approve the filing so that the tax will be deducted or credited. Automating the compliance issues is one of the biggest advantages of the payroll software must say.

These are a few main benefits of why you should consider payroll software for any business. There are many payroll software’s available these days as the organizations are growing tremendously, there is a huge need that they need to incorporate the employee pay structure in a detailed and structured way.

Good payroll software can make and break any organization. So, consider all the tips and ensure that you are buying it from a licensed company because any small mistake in choosing the wrong is worth the name and fame of the organization. Especially cloud-based payroll software can be beneficial. Because cloud-based payroll software can be an added advantage because cloud-based software can be easily integrated with employee resource management. So, choose the best payroll software from all the available options in the market.

It is not the amount that can decide the quality of payroll software. But it is the features that are worth spending make it the best payroll software. All these reasons are more than enough to prove that payroll software is essential for any business. Do not waste time on manual payroll processes in this competitive corporate world. Instead, you can use the time saved on other processes which can develop the organization.